Trendlyne is an investment platform that assists investors in selecting and analyzing stocks using their F&O screener (which includes option screens). It provides other features including mutual fund portfolio tools, watchlists, as well as real-time news feeds. Trendlyne aims to help individuals make informed investing decisions by providing them with the essential data and tools to evaluate stocks, track portfolios, and stay up to date on market trends.

Today, Trendlyne is one of the most sought-after stock analysis firms. Trendlyne’s stock research reports are sought after by brokers, the media, investors, and traders. The company earns tremendous from B2B business from significant brokerage houses like HDFC Securities, ICICI Securities, IIFL, 5paisa, and many others. On the other hand, trendlyne.com is not a SEBI registered investment advisor or a broker dealer. You understand and recognize that there is a very high degree of risk involved in trading securities.

The company serves millions of retail and corporate consumers in India and internationally. Trendlyne has 4.6/5 ratings with 4.09k reviews along with more than 500k downloands. Furthermore, the strategic partnership with IIFL Securities, as evidenced by IIFL’s significant stake of 20.55% in Trendlyne after acquiring an additional 6.25% stake in 2020, demonstrates major industry players in the market.

Open an account with Angel One

Founders

Amber Pabreja and Devi Yesodharan are Trendlyne’s foundes who combined their experience and ambition to build a dynamic platform for stock market aficionados. Trendlyne, which launched in Bangalore in 2016, intended to revolutionize stock screening and analysis. Their platform includes a variety of capabilities, ranging from free tools for basic analysis to paid services that go deeper into market research, provide stock alerts, visualization tools, and deliver trending business news. Pabreja and Yesodharan’s leadership and unique platform have positioned Trendlyne as a go-to resource for investors looking for detailed insights into the stock market landscape.

Features of Trendlyne

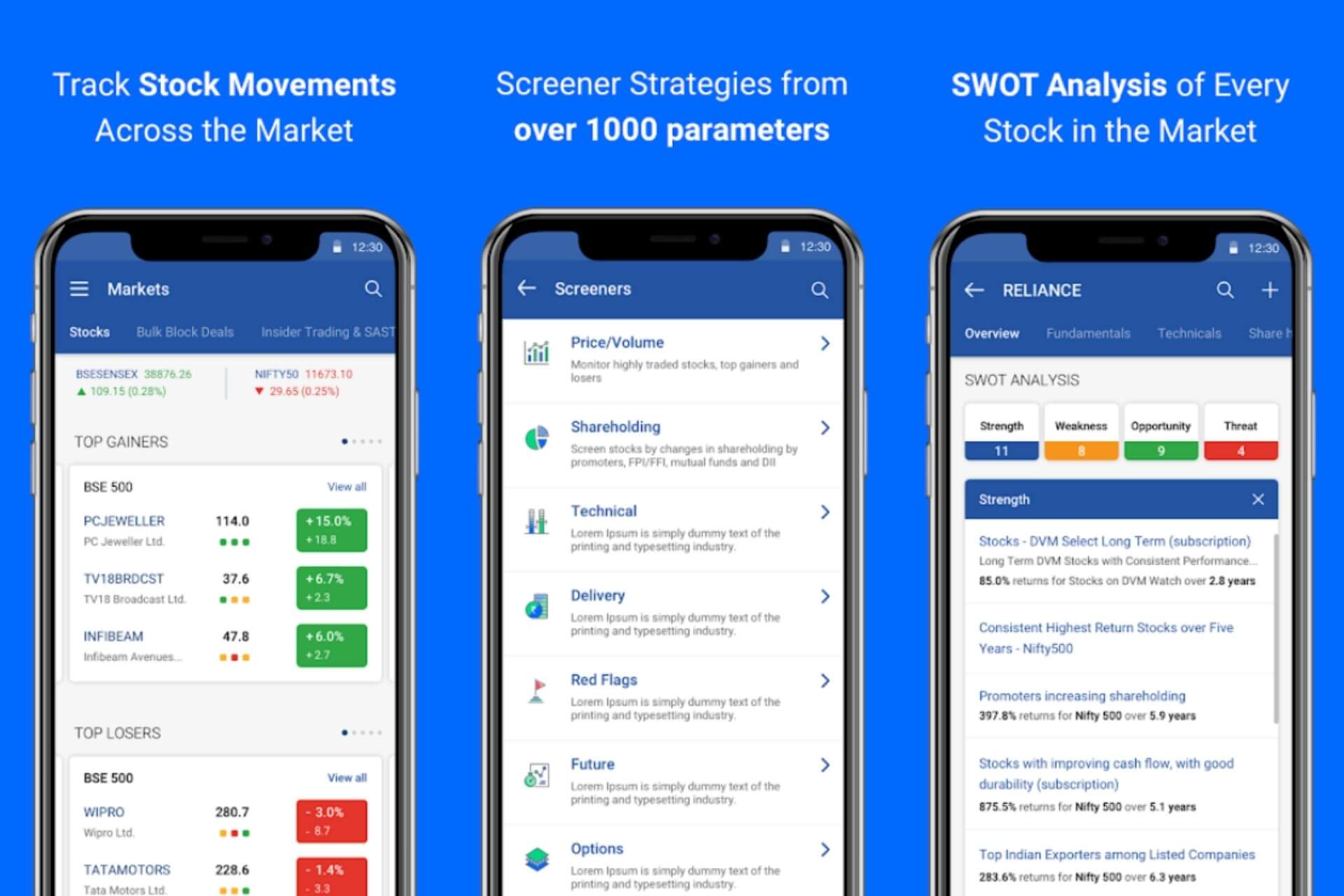

Trendlyne provides a variety of stock analysis tools that help investors make informed decisions. These features include the following:

- Stock Screener:

Trendlyne offers investors a variety of stock screeners, including DVM stock screeners and financials livestock screens. These screeners include a variety of factors, allowing investors to filter and narrow down stocks based on their unique needs.

- Stock Checklists:

A checklist is used to evaluate stocks, considering a variety of characteristics such as financials, ownership, valuation, momentum, and relative performance. The checklist evaluates the stock’s performance against each criterion and assigns a pass or fail percentage, providing investors with an overall assessment of the stock.

- Verified DVM Stock Scores:

Trendlyne’s DVM scores are comprised of three distinct factors: Durability, Valuation, and Momentum. These scores provide insights into several facets of a stock’s performance, assisting investors in determining its fit for their portfolio. Stocks are classified as High DVM, Mid DVM, or Low DVM, allowing investors to identify prospective investment possibilities based on these scores.

- Durability Score- This score indicates whether the company’s financial performance is good and constant, with stable revenues, profits, and cash flows, as well as low debt.

- Valuation Score- This score determines if the stock is priced competitively at the current P/E, P/BV, and share price.

- Momentum Score– A higher momentum score implies that a stock is being bought more than sold and is considered bullish.

- Momentum Score

The Trendlyne Momentum Score evaluates if a stock is bullish or bearish. Each stock’s daily calculation takes more than 30 technical indicators into account. A stock is deemed to have a good momentum score if its score exceeds 50. The Momentum function provides detailed technical information about a stock, such as RSI, MFI, MACD, MACD Signal Line, Trendlyne Momentum Score, and Delivery% volume Avg Week.

- RSI (Relative Strength Index) measures the change in price momentum for a stock.

- MFI (Money Flow Index) measures the stock’s price and volume to determine if it is overbought or oversold.

- MACD (Moving Average Convergence Divergence) is a technical indicator that measures price fluctuations.

- MACD Signal line showcases the stock’s trend, enabling identification of whether it is currently showing a bullish or bearish movement.

- SWOT Analysis:

Trendlyne uses the SWOT (Strengths, Weaknesses, Opportunities, and Threats) evaluation methodology to assess stocks. Trendlyne’s built-in screeners are organized into SWOT categories, allowing investors to gain a full grasp of a stock’s situation and prospects.

- Forecast Estimates:

The Trendlyne display provides stock forecasts. Investors can view parameters such as the most bullish or negative forecasts, allowing them to make more informed investment selections based on these predictions.

MF Fund Details and Expense Ratio

| Investment Details | Amount (Rs) |

| Minimum SIP (AIP) | 500.0 |

| Minimum Initial Purchase | 5000 |

| Minimum Additional Purchase | 1000 |

| Net Expense Ratio | 2.35% |

If you do not login at trendlyne.com for a continuous period of 90 days your registration may get automatically cancelled.

Manage and track your investments.

- The portfolio summary allows you to assess the performance of certain stocks over a variety of time periods, including one week, one month, three months, and one year.

- The Portfolio Analysis function provides a thorough summary of many metrics, including your portfolio’s overall performance compared to a consolidated benchmark, key data, and the best- and worst-performing stocks in your portfolio. It also displays the top earners and stocks with attractive prices in your portfolio.

- The Portfolio NAV tool allows you to view the Net Asset Value of the companies in your portfolio as well as their returns across a variety of time periods, including one, three, six, and twelve months.

- Portfolio Pivot divides your portfolio into four categories based on company size: large-cap, mid-cap, small-cap, and unclassified.

Starfolio

Trendlyne has several unique features that are solely available to Trendlyne customers. STARFOLIO is one such feature. STARFOLIO assists in the creation of index beating baskets that outperform the index. This function allows you to combine stocks, gold, and ETFs to create a basket that can outperform the index over time. It contains three categories: Create a high-return portfolio with just one click. Create your basket and set alerts. Create an automatic basket by entering risk, value expectations, and target criteria.

Metrics

| Feature | Description |

| Free Metrics | 52-week high-low, 1 yr return vs Nifty50, Avg broker target, Market Cap., Price to Book Ratio, TTM PE Ratio, TTM PEG Ratio, Operating Revenues, Net Profit. |

| Premium Metrics | RSI (Relative Strength Index), MFI (Money Flow Index), MACD (Moving Average Convergence Divergence), MACD Signal Line, SMA (Simple Moving Averages), EMA (Exponential Moving Average), Forecaster, Target Price, Net Income, Free cash flow, EBIT, Dividend/share, Capital Expenditure, Cash EPS, Cashflow/share, Interest Expense, Depreciation & amortization. |

| Stock Alert | Set alerts for shares based on price, SMA, research, and volume, sent to your email. |

| Forecaster Feature | Provides three estimates: Consensus Estimates, Real-Time & Historical Estimates, Detailed Estimates, based on analyst calls, projections, research, and modeling. |

Subscription Charges

Annual plans range from ₹1190 to ₹9900 for different service levels

| Plan | Monthly Price | Yearly Price |

| Basic | ₹119 | ₹1190 |

| GURUQ | ₹219 | ₹2190 |

| STARTQ | N/A | ₹9900 |

Premium Subscription Features

| Plan | GURUQ | STARTQ |

| Best Dvm Stocks | Yes | Yes |

| Forecaster | Yes | Yes |

| Stock Report | Unlimited | Unlimited |

| Portfolio Report | Yes | Yes |

| Data Downloader | 2000 rows | No limit |

| Expert Stock Screener | Yes | Yes |

| Real Time Alpha Alerts | Unlimited | Unlimited |

| Research Report | Yes | Yes |

| Number Of Watchlist | 30 | 200 |

| Alerts Superstar Daily Deals Stock Alerts | Hourly | Hourly |

| Price Target Alerts | 150 | 500 |

| Events Announcements Alerts | Daily | Hourly |

| Stock Screener Alerts | 75 Daily Frequency | 300 15Min. Daily Frequency |

| Number Of Backtests | 200 (annually) | 1200 (annually) |

| Rebalances Per Backtest | 60 | 150 |

| Stock Screener Rewind | Monthly | Weekly |

Pros of Trendlyne

- The app’s extensive data and analysis tools, including backtesting features, stock screeners, and stock ratings like DVM scores.

- Trendlyne is helpful for making investment decisions, tracking portfolios, and getting insights into stock fundamentals.

- Features like custom screeners, alerts, and access to financial data are highly valued by users, especially those who are serious about stock market analysis.

- The app’s development team is praised for addressing user feedback and continuously improving the app with updates and new features.

- Users find the app’s pricing for premium features reasonable, considering the value it provides in terms of stock analysis and portfolio management.

Cons of Trendlyne

- Several users report technical issues such as delayed data updates, login problems, and occasional bugs in the app’s functionality, like screeners not working properly or data not showing correctly.

- Dissatisfaction with the app’s customer support, citing slow responses or lack of resolution for their issues, especially after purchasing a subscription.

- A few users mention difficulties in navigating the app or finding specific features, suggesting that the user interface could be improved for better usability.

- Concerns about data accuracy, especially in comparison to official sources like NSE, highlighting discrepancies in data presentation and delays in updates.

- Despite improvements like 1-minute NSE delayed feed, some users still find the app lacking real-time data updates, impacting features like price alerts and notifications.

Open an account with Upstox

Conclusion

Trendlyne has become the robust and comprehensive investment platform, packed with lots of tools and features that are useful for both amateurs’ investors and experienced professionals. It is one of the best platforms that offers all these diverse types of screeners, analysis tools such as DVM scores, portfolio management as well as real-time news updates to anyone seeking for an informed decision on investment. While Trendlyne offers a wealth of tools and features for stock analysis and portfolio management, it’s important to note that it’s not a SEBI registered investment advisor or broker dealer. Some users have found it to be incredibly sophisticated and useful tool for stock analysis while others suggested ways in which the platform can be improved by correcting various bugs, better customer support, enhancing user-interface among other aspects. On the whole, Trendlyne’s strong-points include rich functionality and valuable insights thus making it an invaluable addition to stock market analysis and portfolio management space.