Table of Contents

How the Indian Rupee Compares with Other Currencies – 10-Year Comparison Data (2003 – 2023)

What Makes the Indian Rupee Lag Behind the US Dollar?

Can the Indian Rupee Ever Beat the US Dollar?

The Indian Rupee (INR), represented by the symbol ₹, is the official currency of India. Over the years, the rupee has witnessed fluctuations in its exchange rate compared to other major global currencies. Find out how the Indian Rupee compares with some of the top global currencies, shedding light on the factors that influence the Indian currency value and performance.

Open an account with Angel One.

How the Indian Rupee Compares with Other Currencies – 10-Year Comparison Data (2003 – 2023)

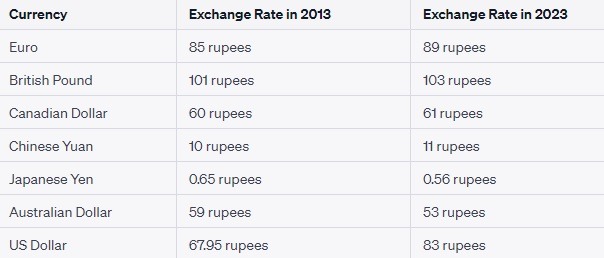

The Indian Rupee has demonstrated a remarkable degree of stability when compared to various major currencies over the past decade. Here is a 10-year comparison of the Indian Rupee against key global currencies:

Euro

The India Rupee to Euro exchange rate went from 85 rupees in September 2013 to 89 rupees in September 2023, indicating a relatively stable performance.

Read on – Indian Economy in 2024: Financial Predictions by Top Experts.

British Pound

The rupee is value in relation to the British pound increased modestly, from 101 rupees to 103 rupees (current pound price in India) over the last ten years, showing resilience against the pound.

Canadian Dollar

The Canadian dollar to Indian Rupee had minimal movement, with the Indian money value shifting from 60 rupees to just 61 rupees within the last decade, highlighting a stable exchange rate.

Chinese Yuan

The Indian Rupee appreciated marginally against the Chinese yuan, rising from 10 rupees to 11 rupees over the 10-year period.

Japanese Yen

In contrast, the rupee strengthened against the Japanese yen, moving from 0.65 rupees to 0.56 rupees, indicating a favorable trend for India.

Australian Dollar

The Indian currency rate exhibited strength against the Australian dollar, declining from 59 rupees to 53 rupees in the last ten years, further illustrating its resilience.

Brazilian Real

The Indian Rupee significantly appreciated, surging by about 65% compared to the Brazilian real over the last decade, reflecting its robust performance.

Russian Rouble

The Indian currency exchange rate demonstrated substantial strength, escalating by 123% against the Russian rouble during the same period, solidifying its position in the global currency landscape.

US Dollar

The Indian Rupee has either maintained a consistent level or exhibited strength against various major currencies, except the US dollar. This indicates a trend of the dollar price in India today getting stronger relative to the rupee, rather than the rupee getting weaker.

Notably, between 2004 and 2014, the rupee depreciated against all major currencies, emphasizing the recent resilience and stability of the Indian Rupee. Currently the India to USD trading is around 83 rupees to the US dollar, it is noteworthy that in 2013, one US dollar was equivalent to 67.95 rupees, underscoring the fluctuations in the currency is value over the years.

What Makes the Indian Rupee Lag Behind the US Dollar?

The relative weakness of INR compared to the USD price in India can be attributed to several key factors:

US Federal Reserve’s High Interest Rates

One of the primary reasons for the higher current dollar price in India is the significant increase in interest rates by the US Federal Reserve. The US has seen its interest rates rise substantially over the years, with rates in 2014 at just 0.1%, or even lower.

By 2023, these rates have surged to 5.33%. When the US offers such high returns on investments in dollars, global investors are naturally inclined to prefer the dollar over other currencies.

Inflation and the Pandemic

During the COVID-19 pandemic, the United States resorted to massive money printing to sustain its economy. The consequence of this monetary policy was a surge in inflation, reaching its highest level in 40 years. To combat this inflation, the US Federal Reserve responded by increasing interest rates.

Paradoxically, high inflation did not weaken the US dollar; instead, it led to a stronger dollar. This India currency to dollar phenomenon can be explained by the fact that the United States, as a long-standing superpower, operates under a different set of economic rules. When global economic conditions deteriorate, more individuals turn to the US dollar as a safe haven, driving up demand and strengthening the currency.

The Challenge of Dollar Liquidity

Another factor contributing to the rupee’s challenges is the fall in forward premiums, linked to concerns over dollar liquidity. The Reserve Bank of India (RBI) has had to intervene frequently to manage the rupee due to the weeks-long surge in US Treasury yields and oil price volatility.

Low forward premiums make it more attractive for importers to hedge their positions, which can exert further downward pressure on the rupee. The fall in forward premiums has been fueled by apprehensions about the dollar’s liquidity, especially evident in the rupee/dollar cash swap market.

Banks use this market to address daily rupee and dollar liquidity mismatches, and the prevailing depressed dollar/rupee cash swap rate indicates high demand for cash dollars. Consequently, this dynamic can add to the rupee’s challenges and hinder the RBI’s efforts to stabilize the currency.

Can the Indian Rupee Ever Beat the US Dollar?

The Indian Rupee (INR) has undergone a significant transformation in value over the years, with its worth relative to the US Dollar (USD) changing notably since India gained independence in 1947. Initially, 1 INR was equivalent to 1 USD, signifying parity. However, a gradual depreciation of the INR has occurred since then.

To provide context, historical metrics reveal that in 1913, the USD Dollar Rate in India was 0.09 INR to 1 USD, and by 1948, it had increased to 3.31 INR. This 1 Dollar in rupees India trend continued, with the exchange rate reaching 3.67 INR in 1949 and 7.50 INR in 1970.

Recent developments have also impacted the 1 dollar price in India performance. In 2022, global events led to a significant depreciation of over 11%, highlighting the challenges the INR faced. Present market conditions indicate the USD’s strength in comparison to the rupee, raising concerns about potential future challenges for the INR.

To enhance the INR’s global market appeal, India must embark on a series of reforms. These include:

1. Upgrading its financial markets

India needs to modernize its financial markets by embracing advanced technologies, increasing transparency, and fostering innovation to attract global investors.

2. Ensuring a stable regulatory environment

India should establish consistent and investor-friendly regulatory frameworks that promote trust and predictability in financial transactions, encouraging foreign investments.

Open an account with Upstox.

3. Enhancing export competitiveness

By focusing on improving the quality and competitiveness of its exports, India can boost its international trade and attract more foreign capital, strengthening the INR’s global standing.

The long-term economic prosperity and stability of India hinge on persistent efforts to internationalize the INR. Collaborative efforts involving the government, the Reserve Bank of India (RBI), and the private sector are crucial to enact necessary reforms and establish the financial infrastructure required to solidify the INR’s status as an international currency.

Read on – Top 10 Biggest Economies in the World 2023: GDP and GDP Per-Capita Comparison.

Conclusion

The Indian currency exchange rate with other major global currencies is subject to a multitude of factors, including economic policies, global events, trade relations, and monetary policies. Keeping an eye on these dynamics can provide insights into the rupee’s performance and its standing in the international currency landscape. As India continues to make strides in economic reforms and global trade, it will be interesting to watch the position of the Indian Rupee vis-à-vis other currencies in the world, especially that of the position of the USD.