Table of Contents

Why Open an Account with Neo Banks?

Top 12 Neo Banks Shaping Indian Economic Growth Story: Which Ones to Opt for in 2024 and Beyond

Fintech innovations, including Neo Banks, have allowed enhanced customer experience and satisfaction. Are you aware of Neo Bank meaning? Neo banks, a new breed of digital banks, have emerged as pivotal players in the Indian economic landscape. These fuel Indian economic growth and development by increasing access to credit, enhancing digital transactions, and contributing to India’s financial ecosystem’s overall resilience and dynamism.

Neobanks are gaining popularity across the globe as they provide the next level of convenience for their customers, for a better experience, unlike any traditional banking experience. Neo banks are poised to play a transformative role in shaping India’s economic future. Find out why you should consider opening an account with any of the neobanks in India, and the best neo-banks shaping Indian economic growth that you can opt for.

Open an account with Angel One.

Why Open an Account with Neo Banks?

In recent years, neo banking in India have disrupted the traditional banking landscape by offering a range of benefits that are attracting customers globally. Here are some compelling reasons to consider opening an account with a neobank:

- Convenient Digital Banking Services: Neobanks offer a seamless digital experience for tasks like bill payments, prepaid cards, money transfers, and savings accounts. You can manage your finances from the comfort of your mobile device.

- Highly Personalized Services: Neobanks provide highly customized, flexible, and user-friendly services that cater to individual preferences and financial needs.

- Available Round the Clock: With neobanks, you can access your accounts and perform transactions at any time, day or night. This round-the-clock availability is a significant advantage for customers with busy schedules. Naturally, these have become crucial to the Indian economic growth story.

- User-Friendly Mobile Apps: Neobanks typically offer user-friendly mobile apps with intuitive interfaces, making it easy for users to navigate and manage their finances.

- Helps manage funds easily: Neobanks often provide access to financial management tools and resources that can help you make informed decisions about your money.

- Real-Time Notifications: Many neobanks offer real-time notifications for transactions and account activities, helping you stay on top of your financial situation.

- High Security: Neobanks prioritize the security of your financial data and transactions, implementing advanced security features to protect your information.

- Affordability: Neobanks often provide their services at a lower cost compared to traditional banks, making banking more accessible and affordable.

With these advantages, neobanks are contributing to Indian economic growth. These are increasingly becoming the go-to choice for those looking for a modern and hassle-free banking experience.

Top 12 Neo Banks Shaping Indian Economic Growth Story: Which Ones to Opt for in 2024 and Beyond

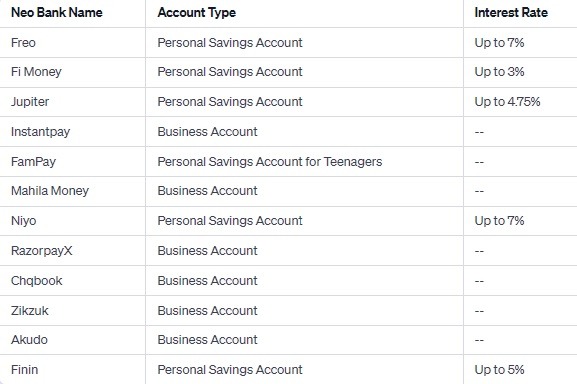

In India, the neobanking landscape is evolving rapidly, with numerous players offering a variety of services to make the most of the Indian economic growth. Here are the top 12 neo banks in India that you should consider in 2024 and beyond:

Freo

Freo is a leading neobank in India, providing modern banking solutions for Indian and Southeast Asian millennials. This neo bank India offers a digital savings account, a flexible credit line, a credit and EMI card, and various financial utilities. Freo prioritizes data security and is associated with trusted brands like VISA, Equitas, NPCI, and RBI.

Fi Money

Fi Money is backed by the Federal Bank and offers multiple savings accounts, some with zero balance requirements. It provides a Visa debit card, and your balance up to ₹5 lakh is insured.

Jupiter

Jupiter, in partnership with the Federal Bank, offers easy and fast account opening, detailed account statements, and a robust support system. It offers zero balance facilities and provides 1% reward points for debit card and UPI transactions.

InstantPay

InstantPay is a versatile banking platform for individuals and businesses. It offers instant account opening, cash deposits, active account tracking, and 24/7 customer support. It partners with banks like Axis Bank, Indusind Bank, ICICI Bank, and Yes Bank.

FamPay

FamPay allows you to open an account in minutes and offers virtual payment cards for online shopping. Its FamPay Future initiative encourages younger generations to engage in discussions about financial systems and policies.

Mahila Money

Mahila Money is a neobank exclusively for female entrepreneurs, and is thus outstanding in the Indian economic growth story. It provides collateral-free loans at a 20% annual interest rate and fosters communication among women regarding their unique experiences in work and study.

Niyo

With over 2.5 million customers, Niyo aims to make banking smarter, safer, and simpler. It offers various products and services to enhance the banking experience.

RazorpayX

Originally launched as an API and dashboard pay-out platform for merchants, RazorpayX now offers features like automating payroll, setting credit limits for enterprises, automating tax payments, and granting urgent loans.

Chqbook

Chqbook empowers small business owners and entrepreneurs with personalized financial services, including current accounts, transaction rewards, digital ledgers, insurance coverage, and zero-fee loans.

ZikZuk

ZikZuk focuses on SME founders, offering a credit card for founders with excellent credit scores and contact banking to help manage business finances. It also provides unsecured loans for business funding.

Akudo

Akudo aims to teach economic freedom to the youth by providing prepaid cards for teenagers under parental supervision, encouraging saving habits with reward points.

Finin

Finin is an AI-powered neobank app that offers easy account opening and management, as well as insights to improve users’ finances. Open acquired Finin at the end of 2021, indicating growth potential.

These neobanks offer a range of services, making them suitable for various customer needs. The choice of the best neobank for you will depend on your specific financial requirements and preferences.

Open an account with Zerodha.

Conclusion

Neobanks have quickly established themselves as a major force in Indian economic growth, offering customers a modern, convenient, and cost-effective way to manage their finances. In India, the neobanking landscape is flourishing, with a variety of options to choose from.

As we move into 2024 and beyond, neobanks are likely to play an even more significant role in the Indian economic growth and the financial lives of Indians, providing innovative solutions and enhancing financial inclusion. Whether you are looking for a digital savings account, a flexible credit line, or a user-friendly mobile app, the top 12 neobanks mentioned here have you covered.