Table of Contents

What is Hyper-Personalization?

Will Hyper-Personalization Be a Future Trend in Banking?

What is the Scope of Hyper-Personalization in Indian Banking?

Statistics about Hyper-Personalization and Fintech Sector in India

Over the past few years, India has witnessed a rapid and significant transformation in its financial services industry, driven by the integration of cutting-edge technologies like Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT). As a result, the Indian Fintech industry is experiencing a wave of innovation and digitalization, marking only the beginning of AI adoption in the sector.

Get an idea about the concept of hyper-personalization in banking and know its potential as a future trend in the Indian Fintech industry.

Open an account with Angel One.

What is Hyper-Personalization?

In a survey conducted by NTT DATA across 5000 customers and 500 financial institutions in 8 countries, it was found that proactive personalized and individualized financial services are in high demand. Hyper-personalization in banking refers to the customization of financial services to such an extent that they are tailored to each individual customer’s unique needs and preferences. This involves a deep understanding of the customer’s financial history, goals, aspirations, and even their social media activity and geolocation data.

Modern customers are no longer satisfied with traditional banking roles that merely enable financial transactions. They seek financial organizations to play a more active role as financial advisors, offering personalized guidance on savings, investments, and spending. Customers are increasingly willing to share their data with banks in exchange for tailored recommendations and financial advice. However, it is essential to emphasize that customers retain control over their data and can override the financial institution’s recommendations.

Hyper-personalization relies heavily on AI and data analytics to deliver individualized financial guidance and services at scale. By leveraging AI, top Indian fintech companies and banks can provide customers with services that align with both their financial and social goals.

Read on – India’s Economic Growth in 2024 and Beyond: Can Neo Banks Be a Game-Changer?

Will Hyper-Personalization Be a Future Trend in Banking?

Hyper-personalization is more than just a buzzword; it is a fundamental shift in the way banks interact with their customers. In the increasingly digital world, customer acquisition and retention have become more dynamic. Customers are now more willing to switch banks as their needs evolve and as technology advances. The COVID-19 pandemic has accelerated the transition to digital financial services, further emphasizing the importance of mobility and agility.

To stay competitive, banks need to establish partnerships with non-financial services, diversifying their offerings and improving customer experience. While technology plays a significant role in hyper-personalization, the regulatory landscape is also evolving, and data infrastructure is being developed to support this transformation.

The Reserve Bank of India (RBI) has introduced innovative products such as IDRBT and NPCI, encouraging participation and interoperability among non-banking institutions. Measures like 2FA or AFA (Two-Factor Authentication or Additional Factor Authentication) aim to minimize risks and provide customer-friendly transaction models. Initiatives like RBI’s Regulatory Sandbox promote innovation while maintaining efficiency.

What is the Scope of Hyper-Personalization in Indian Banking?

The scope of hyper-personalization in Indian banking is poised for tremendous growth and transformation as the financial services industry integrates advanced technologies such as AI, ML, and IoT. India has been experiencing a Big Data Revolution, and Fintech companies areon a rapid upward trajectory, with predictions of substantial growth in the coming years.

The demand for hyper-personalized financial services is on the rise, as demonstrated by a survey conducted by NTT DATA. Customers are increasingly looking for individualized financial advice and services that go beyond traditional banking roles. They are willing to share their data, including social media activity, geolocation, financial history, and goals, in exchange for personalized recommendations and guidance. This trend is reshaping the relationship between banks and customers, with the customer retaining control over their data and decisions.

In terms of technology adoption, Indian banks are at the early stages of integrating AI, machine learning, and data analytics. However, the potential for growth is immense, with AI playing a crucial role in attracting and retaining customers. The regulatory landscape is evolving, with a focus on digital modes of customer acquisition and data infrastructure development. This, along with changing customer profiles, is facilitating technological advancements in the financial sector.

The importance of data and data accuracy will continue to grow, and customer-specific banks, hyper-personalization, and partnerships will shape the banking landscape. The Fin Tech boom in India presents opportunities for personalized communication, customer engagement, and retention, creating a dynamic and rapidly evolving financial services ecosystem. Hyper-personalization is not limited to banking but also extends to other industries such as real estate, retail, and the corporate sector.

Read on – Indian Rupee: How does it compare With Other Top Global Currencies?

Statistics about Hyper-Personalization and Fintech Sector in India

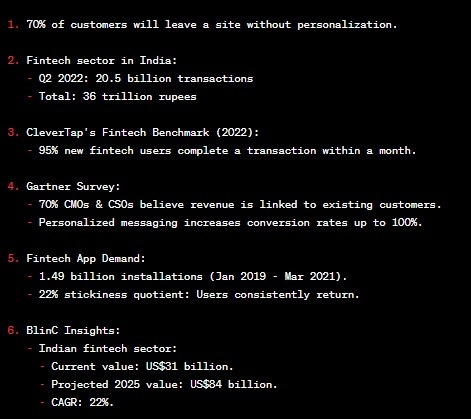

Personalization plays a pivotal role in the success of websites, with a staggering 70% of customers being more likely to leave a site that fails to offer a tailored experience. This shift towards hyper-personalization is evident in the booming Fintech startups revolution in India, which recorded over 20.5 billion online transactions, amounting to a staggering 36 trillion rupees in Q2 2022.

CleverTap’s Fintech Benchmark Report for 2022 revealed that 95% of new Fintech users complete a financial transaction within their first month, underlining the importance of immediate engagement.

Moreover, a Gartner survey underscores the revenue implications for businesses, with 70% of CMOs, CSOs, and more than half of general managers acknowledging that their earnings are intricately linked to existing customers. Leveraging personalized messaging aligned with individual customer journeys has allowed companies to achieve up to a 100% increase in conversion rates.

The demand for Fintech technology services in India is unmistakable, with 1.49 billion installations of Fintech apps recorded between January 2019 and March 2021. Furthermore, CleverTap’s Fintech Benchmark Report for 2022 highlights the remarkable stickiness of Fintech apps, with a 22% stickiness quotient, indicating that nearly one-quarter of monthly active users consistently return to these apps.

BlinC Insights reports that India’s Fintech sector, valued currently at US$31 billion, is projected to expand to $84 billion by 2025, with a compound annual growth rate (CAGR) of 22%. These statistics underscore the significance of personalization in the thriving Indian Fintech landscape, where understanding and catering to individual customer needs have become integral to success.

Fast Facts:

Open an account with Upstox.

Conclusion

Hyper-personalization is set to be a future banking trend in India, driven by AI and new-age technology. As the fin technology sector continues to evolve, it is essential for banks and Fintech companies to embrace this trend and provide customers with tailored financial services that meet their individual needs and aspirations. By doing so, they can navigate the path to success in the rapidly changing Indian financial tech landscape.