Table of Contents

5 Powerful Bearish Candlestick Patterns

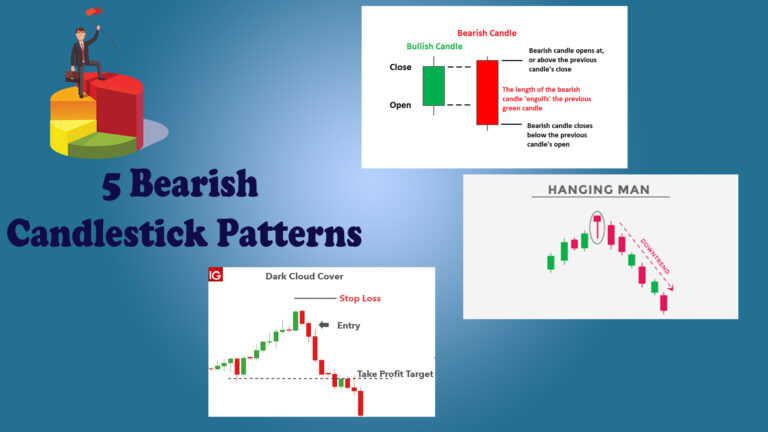

1. Hanging Man Candlestick Patterns

2. Dark Cloud Cover Candlestick Patterns

3. Bearish Engulfing Candlestick Patterns

4. The Evening Star Candlestick Patterns

5. The Three Black Crows Candlestick Patterns

A candlestick is a method of visualizing price movements in trading. Candlestick patterns, originally known in Japanese as candle line, play a crucial role in trading since centuries. They are a technical tool that uncovers market sentiments for traders in the stock and, indeed, in any other trading market. Candlestick patterns include several more complex formations. Yet, the one rule of thumb is simple: the more complex the pattern, the greater the price moves.

Broken down into a single pattern, a candlestick is made up of a body – in which the larger section illustrates the range between opening and closing prices – and the smaller ‘wicks’ or ‘shadows’ that represent the range of price movement. The color of the body tells the trader about market sentiments; a green or white body suggests bullish activity and red or black suggests bearish activity. Read and know all about the 5 important bearish candlestick patterns, such as Hanging Man, Dark Cloud Cover, Bearish Engulfing and More.

Open an account with Angel One.

5 Powerful Bearish Candlestick Patterns

Bearish candlestick patterns are formed when the closing price is lower than the opening price. It indicates that sellers control the price for the majority of the trading period. These patterns signify the potential conclusion of an ongoing uptrend, possibly signaling a forthcoming shift towards a downtrend. These patterns can manifest as single or multiple candlestick formations.

Read and know about the 5 Bullish Candlestick Patterns. Or continue reading to know about the 5 common, powerful bearish candlestick patterns:

1. Hanging Man Candlestick Patterns

The Hanging Man pattern is a bearish reversal candlestick formation characterized by a lengthy lower shadow and a diminutive real body. When this bearish candlestick pattern emerges at the conclusion of an upward trend, it signals a weakening of the current price momentum. It suggests that although the bulls initially drove prices upward, they were unable to sustain the upward push.

The small real body signifies a minimal difference between the opening and closing prices. Also, the lower shadow should be approximately twice the length of the body, while there should be no upper shadow present. This pattern assists traders in closing their long positions and initiating short positions.

2. Dark Cloud Cover Candlestick Patterns

The Dark Cloud Cover is a bearish reversal candlestick pattern that emerges at the conclusion of an uptrend, signifying a potential weakening of the upward momentum.

Comprising two distinct candlesticks, the first is characterized by a bullish candlestick, followed by a bearish one. This pattern gains significance as prices ascend, as it signals the potential for a reversal to the downside.

3. Bearish Engulfing Candlestick Patterns

The bearish engulfing pattern serves as a signal for a potential shift in market sentiment from bullish to bearish. It indicates the impending end of an uptrend and a probable decrease in prices, primarily driven by selling pressure from market participants. This pattern manifests itself when the market is at the peak of an uptrend.

When the bearish engulfing pattern emerges, it often marks the start of a reversal in the ongoing uptrend, as sellers become more active in the market, causing prices to decline. This pattern materializes through the formation of two candles, with the second bearish candle completely engulfing the prior green candle’s “body.”

4. The Evening Star Candlestick Patterns

The Evening Star candlestick pattern serves as a valuable tool in traders’ arsenals, helping them discern the impending shift from an uptrend to a downtrend.

Comprising three distinct candles, this pattern unfolds as follows:

- A substantial bullish candlestick,

- A diminutive-bodied candle, and finally,

- A bearish candlestick.

These Evening Star formations materialize at the peak of an uptrend, sounding a clear alarm that the prevailing upward momentum is about to give way to a downward trajectory.

Open an account with Zerodha.

5. The Three Black Crows Candlestick Patterns

The Three Crows pattern comprises various candlestick patterns utilized to forecast a reversal from an uptrend to a downtrend. This formation occurs when sellers assert their bearish influence, leading to three consecutive days of declining prices.

Traders may consider initiating a short position once this bearish candlestick pattern takes shape. To confirm the presence of this candlestick pattern, traders are advised to complement it with volume data and technical indicators.

Read on: What are Candlestick Charts: Basic Features, Basic Patterns and More?

Conclusion

Understanding candlestick patterns is the key to successful trading. Not only it can help traders predict future market movements, but also provide a clearer picture of market sentiment. In order to be effective, Bearish reversal patterns need to materialize as the uptrend reaches its culmination; otherwise, they might resemble continuation patterns.

It is advisable for traders to confirm the signals generated by these bearish reversal patterns with other indicators like trading volume and resistance levels, so as to feel more confident about the impending trend reversal signals.