Are you looking at Flattrade and wondering what are the charges ? You are in the correct place! While Flattrade is well-known for its 0% broking fees, there are a few additional costs to consider when trading. Let us get to know all of the fees so you can trade with confidence and get the most out of this platform.

What is Flattrade?

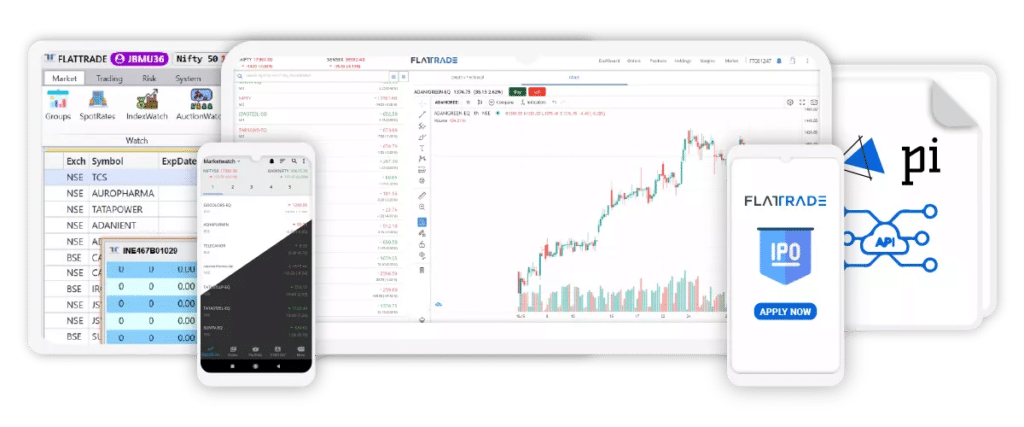

Flattrade is a famous broking platform that provides 0% broking on equities delivery trades. However, like most platforms Flattrade also charges additional fees for its services, which can be different depending on the type of transaction, facilities used, and additional services used by you. The following is the list of Flattrade charges.

Open an account with Angel One– Click here

Direct Charges

Service | Charges | ||||

|

| ||||

| Rs.0 | ||||

DDPI Charges | Rs. 175 |

Brokerage Charges

Service | Charges |

Equity Delivery | Rs.0 |

Equity Intraday | Rs.0 |

Equity Futures | Rs.0 |

Equity Options | Rs.0 |

Currency Futures | Rs.0 |

Commodity Futures | Rs.0 |

Other Charges

Service | Charges |

DP Charges | Rs.20 + GST per scrip (per sale transaction) |

Pledge Charges | Rs.20 + GST per request |

Unpledge Charges | Rs.20 + GST per request |

SEBI Turnover Fees | Rs.10 per crore |

Open an account with Upstox– Click here

MTF (Margin Trading Facility)

Flattrade offers Margin Trading Facility (MTF), which allows you to Support your investments.

Service | Charges |

Margin Trading Facility (MTF) Interest | 18% per annum |

- Is Flattrade truly a zero-brokerage platform?

Yes! Flattrade provides zero brokerage for equity delivery, intraday trades, equity futures, options, and even currency and commodity futures.

2. What are the fees for account opening and maintaining with Flattrade?

Flattrade charges a one-time account opening fee of Rs. 200 plus 18% GST. The good news is that there are no annual maintenance charges (AMC) as well as DDPI Charges are Rs. 175(including GST).

3. Does Flattrade provide a margin trading facility (MTF), and what are the fees for it?

Yes, Flattrade offers margin trading Facility (MTF), allowing you to leverage your investments. The interest charged for using the MTF is 18% per annum.

Conclusion

Flattrade provides zero broking across all sectors, making it a popular choice for traders. However, it is critical to observe additional applicable charges like as account opening fees, DP charges, pledge/unpledge fees, and taxes paid on each transaction. Flattrade is perfect for people searching for a low-cost trading platform, but be aware of various non-brokerage fees that may still affect your overall trading costs.

If you found this post useful, please comment “useful”. And I request you to Please share this post on Facebook/WhatsApp with those who need this.