Table of Contents

What Is Peer-To-Peer (P2P) Lending?

P2P Lending in India: Last 10 Years

P2P Lending in India: Growth of Women P2P Lenders

Future of P2P lending for India Economic Growth: 2024 and Beyond

India has a long history of people lending money to each other based on trust, without the need for collateral or guarantees. This traditional form of lending is now undergoing a technological transformation, giving birth to peer-to-peer (P2P) lending. Know all about the role of P2P lending in India, exploring its evolution in India over the past decade, and its promising future in 2024 and beyond.

Open an account with Angel One.

What Is Peer-To-Peer (P2P) Lending?

P2P lending is a mechanism that connects individuals who want to lend money directly with those in need of financial assistance. It eliminates the need for banks and traditional intermediaries, making the lending process more accessible and efficient.

People often seek loans from traditional financial institutions, but rejection due to various reasons like low credit scores or inadequate paperwork is not uncommon. In such situations, peer to peer lending comes to the rescue.

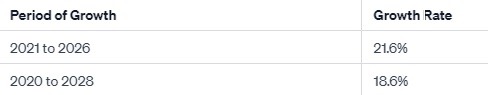

Peer 2 peer lending platforms serve as online marketplaces where borrowers can request loans, and lenders can offer funds. These platforms evaluate borrowers based on various factors, not just their credit scores, and categorize them into different risk groups. Lenders can then choose the borrowers they want to lend to based on risk and return preferences. This system opens up financial opportunities for people with low credit scores and low income, enabling them to access loans for education, business expansion, and more. As per a report, the P2P lending market in India is projected to exhibit a Compound Annual Growth Rate (CAGR) of 18.6% during the period spanning from 2020 to 2028.

P2P Lending in India: Last 10 Years

P2P lending found its footing in India around 2014, and since then, it has grown significantly. As of 2022, more than 3 million investors have registered on P2P lending platforms, collectively investing around INR 20,000 crores in loans, with an AUM of around INR 4,000 crores. The concept of peer – peer lending gained traction in India after the 2008 financial crisis and prompted the Reserve Bank of India (RBI) to introduce regulations in 2017.

While the growth of P2P lending has been impressive, it is essential for investors to be aware of certain critical factors. Borrowers and lenders must register on P2P platforms by providing KYC documents and bank account statements. Lenders transfer funds to an escrow account, which are then disbursed to chosen borrowers.

To manage risk, platforms use algorithms to assess borrowers on various criteria, with creditworthiness affecting the interest rates. Lenders can diversify their investments across multiple borrowers, reducing risk but not eliminating it entirely.

However, peer2peer lending is not without its risks. The primary risk is the default by borrowers, where they fail to repay both interest and principal. While P2P platforms can help in recovery, there is no guarantee. Investors need to be cautious and choose platforms with transparency and a track record.

P2P Lending in India: Growth of Women P2P Lenders

During the fiscal year 2022, a remarkable surge in women investors actively engaging with p to p lending platforms was observed. The number of women investors in this space experienced an astonishing 430% increase compared to the previous fiscal year.

In parallel, there was a substantial 150% growth in women borrowers availing P2P lending services. These statistics reflect the growing interest of women and the trust they are placing in these platforms.

Millennial women, aged 21 to 30, are actively participating in peer to per lending as both borrowers and lenders. Their tech-savvy attitude, social consciousness, and career-focused approach make them comfortable with digital loans and investments.

The growth of women peer to peer loan lenders in India can be attributed to several key factors:

1. Helps focus on financial independence

Women in India are increasingly prioritizing financial independence. Peer to peer financing and lending platforms provide them with a means to take control of their financial destinies. This financial autonomy empowers women, allowing them to make independent investment decisions and manage their funds. The ease of access and user-friendly nature of these platforms align well with the tech-savvy urban women seeking to establish their financial independence.

2. Helps diversify their portfolios

P2P lending platforms offer a diverse range of investment options that attract women investors. Diversifying their portfolios beyond traditional financial instruments is an essential aspect of their financial planning. Peer to per lending provides them with the opportunity to invest in loans to a variety of borrowers, spreading their risk and potentially enhancing their overall investment portfolio.

3. Potential for higher returns than traditional bank deposits

With traditional bank deposit interest rates often remaining low, PTP lending emerges as an attractive alternative. Women investors are drawn to the potential for higher returns that Peer 2 peer lending offers. These platforms can provide returns that surpass those from conventional bank deposits, making it an appealing option for women looking to grow their wealth in an environment of low-interest rates.

The combination of these factors has led to the remarkable growth of women P2P lenders in India. In 2024 and beyond, this trend is expected to continue its upward trajectory, further contributing to the financial inclusion and empowerment of women in the country.

Read on – Top 10 Biggest Economies in the World 2023: GDP and GDP Per-Capita Comparison.

Future of P2P lending for India Economic Growth: 2024 and Beyond

The Indian p 2 p lending market shows immense promise for the future. According to a report by IndustryARC, it is projected to reach $10.5 billion by 2026, growing at a rate of 21.6% between 2021 and 2026. This growth is driven by the appeal of higher returns compared to traditional bank deposits.

However, investors should exercise caution when investing in P2P lending, as these platforms do not offer the same level of insurance as bank deposits. It is also important to understand the payout timeline, which varies from platform to platform.

Peer to Peer lending p2p platforms are focusing on mitigating risks through technology, using AI and machine learning algorithms to match lenders with creditworthy borrowers, thus minimizing the impact of defaults. The ease of access to online financial avenues encourages individuals to take control of their financial decisions.

Open an account with Upstox.

Conclusion

The rise of P2P lending in India signifies a transformation how people access and invest money. While the potential for high returns is enticing, it is not without risks. Investors should carefully choose P2P lending platforms, diversify their investments, and consider factors like creditworthiness, repayment track record, and interest rates. With the industry projected to grow significantly in the coming years, P2P lending offers a promising financial opportunity for both borrowers and lenders, provided they approach it with due diligence and awareness.