Table of Contents

How Are Neo Banks Changing Indian Economic Growth?

Can Neo Banks Revolutionize the Indian Economy in 2024 and Beyond?

Important Data about Neo Banks in India’s Economic Growth

As the India’s economic growth story continues to get better, a notable trend is emerging that might reshape the financial landscape. The rise of Neo Banks, also known as digital-only banks, is gaining momentum in India. These innovative financial institutions offer banking services exclusively through mobile apps, eliminating the need for physical branches. This not only reduces operational costs but also presents unique opportunities and challenges.

Know the potential impact of Neo Banks on India’s economic growth in 2024 and beyond, and its scope in the country for the future.

Open an account with Angel One.

What Are Neo Banks?

Neo Banks are digital-only banks, and represent a transformative approach to banking, adding to the economic growth rate in India. These financial institutions operate exclusively through mobile apps, without any brick-and-mortar branches. Neo Banks leverage technology to provide a wide range of services, which include payments, account management, lending, and investment options.

The absence of physical infrastructure reduces overhead costs, enabling Neo Banks to offer cost-efficient and customer-centric services. However, it is important to note that Neo Banks may not provide the full spectrum of services offered by traditional banks, such as physical cash handling and in-person consultations.

Read on – Indian Economy in 2024: Financial Predictions by Top Experts.

How Are Neo Banks Changing Indian Economic Growth?

India’s economic growth in the recent years has witnessed some amount of contributions from the Neo Banks as well. These include:

- Rapid Growth of the Neo Banking Industry: Just like India’s economic growth, the Neo Banking sector has witnessed significant growth in India, with a remarkable 100% increase from 2017 to 2022. This momentum was further accelerated during the pandemic, driven by new entrants and increased internet penetration.

- Demographic Advantage: India boasts a youthful population, with more than 50% below the age of 25 and over 65% below the age of 35. This demographic shift has altered spending patterns, with increased expenditures in personal, financial services, and insurance. It has led to India’s economic growth.

- Market Segmentation: The Indian Neo Banking Industry is currently fragmented, with Razorpay leading in market share, followed by Instant Pay and Freo. While these players dominate the market, other smaller institutions have a more challenging time gaining traction.

- Regulatory Challenges: Neo Banks in India are not directly regulated by the Reserve Bank of India (RBI). Instead, they partner with licensed banks, NBFCs, and other financial institutions to offer services. This unique model can pose regulatory challenges, which the industry needs to address.

- Barriers to Growth: Despite India’s economic growth being robust, Neo Banks face challenges like high acquisition costs and building customer trust. The lack of physical presence and the need to gain customer confidence in digital-only platforms are hurdles they must overcome.

- Growth Drivers: The Neo Banking industry thrives due to the high adoption of Fintech, lower pricing, and a superior user experience. Their agility and innovative approach are attracting a growing user base.

Can Neo Banks Revolutionize the Indian Economy in 2024 and Beyond?

The impact of Neo Banks on India’s economic growth in 2024 and beyond holds great promise. Their innovative approach and alignment with the changing demographics and consumer preferences create several opportunities:

- Financial Inclusion: Neo Banks can play a pivotal role in expanding financial inclusion, catering to various segments of the society, including women, teenagers, and the gig economy. Their digital platforms can provide accessible banking services to underserved populations.

- Cost Efficiency: By eliminating the need for physical branches, Neo Banks can offer cost-efficient services, potentially leading to lower fees and higher interest rates for customers. This can encourage more people to participate in the formal financial system.

- Technological Advancements: Neo-Banks are at the forefront of leveraging technology, such as AI and blockchain, to enhance user experience and offer innovative financial products. Their agility allows them to adapt quickly to the evolving tech landscape – leading to better financial growth in India.

- Reduced Geographic Limitations: With Neo Banks, customers can access their accounts and conduct transactions from anywhere, reducing geographic limitations. This opens up opportunities for remote and digital businesses to thrive in India’s economic growth story.

However, Neo Banks must address regulatory challenges and build robust security measures to gain trust and continue growing. Additionally, competition in the market may stabilize growth rates in the coming years.

Open an account with Zerodha.

Important Data about Neo Banks in India’s Economic Growth

The Indian Neo Banking market has seen substantial growth in the growing economy in India from 2017 to 2022, driven by the widespread adoption of Neo Banking for payments, the emergence of startups in this sector, and the increasing popularity of contactless payment methods.

Key factors contributing to this growth and economic progress in India include the convenience of instant payments, heightened user awareness, a rise in internet accessibility, and the assurance of secure and efficient transactions, all of which provide a highly satisfying user experience.

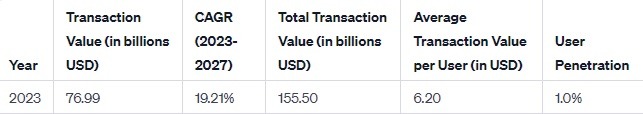

Here is a table detailing the growth of Neo Banks in India’s economy in 2023:

Notably, digital payments in India have surged, experiencing a significant 33% increase during the 2021-2022 fiscal year. Neo Banks such as RazorPay has played a significant role in this surge, empowering users with enhanced purchasing capabilities through partnerships with various merchants and reward programs. This has helped in India’s economic growth as well.

The smartphone penetration rate is also on the rise, projected to increase from 54% in 2020 to an impressive 96% by 2040, ensuring that a growing portion of the population, including rural areas, gains access to digital banking services.

In the competitive India’s economic growth landscape, established players like RazorPay and InstantPay have taken the lead, while newer entrants such as Jupiter, FI Money, Freo, NiyoX, and FamPay are disrupting the market with innovative products and features.

These banks are reaching out to specific segments like women, teenagers, and the gig economy, offering tailor-made financial products and schemes to promote inclusivity across different sections of society.

Conclusion

As the Neo Banking industry continues to evolve, its outlook appears promising in the Indian economic future, with increasing internet penetration and more comprehensive product offerings set to drive continued growth in this digital banking sector. These banks are poised to be a game-changer in India’s economic growth in 2024 and beyond. With a focus on technological innovation, cost efficiency, and accessibility in the future of economy in India, these digital-only banks align with the changing demographic and consumer preferences in India.

As the industry continues to grow and evolve, it has the potential to significantly contribute to India’s economic growth, financial inclusion and drive digitalization in the country. While challenges remain, including regulatory hurdles and competition, Neo Banks are set to be a key driver in the economic graph of India and lead to financial inclusion in the years to come.